3 Reasons to Use a Digital Business Model Canvas

Never before has it been more apparent that the world is moving away from commerce in the physical realm. While it was already obvious as far back as April 21, 2015, when Google launched their mobile-first algorithms, aka Mobilegeddon, a number of factors have created a digital-ripe world of commerce. Then, just five years after Google set the digital world afire with their mobile algorithms, SARS-CoV-2 made a global appearance. For weeks, sometimes months on end, there was no place for consumers, business or private, to purchase products or services they needed other than the internet. This sets the stage for the first of three reasons to use a digital business model canvas template.

1. Ease in Collaboration

With the pandemic still raging, more and more businesses are working in the digital realm, and this is probably the first very good reason to use a digital business model canvas. It is difficult to collaborate in person if workers are faced with working offsite. Other than through teleconferencing, it is virtually impossible to collaborate on any projects, inclusive of developing business models. With a digital business model canvas template, team members can collaborate and work through the template together remotely. All of the business model elements are laid out before them, making it easy to collaborate since everyone is quite literally on the same page.

2. Immediate Access to Data as Needed

Since a business model canvas is used to map out improvements in various aspects of a business, it is necessary to access data. Bear in mind that the ultimate purpose of the business model is to improve a company’s value proposition. Sometimes this means that a business can focus on internal improvements and other times in necessitates competing with other businesses in the same field. Either way, a huge amount of data must be collected and analyzed and since you are already working in the digital arena online, you can quickly move back and forth between your digital business model canvas and the data you are gathering.

3. Ease of Updating or Adding to Current Business Models

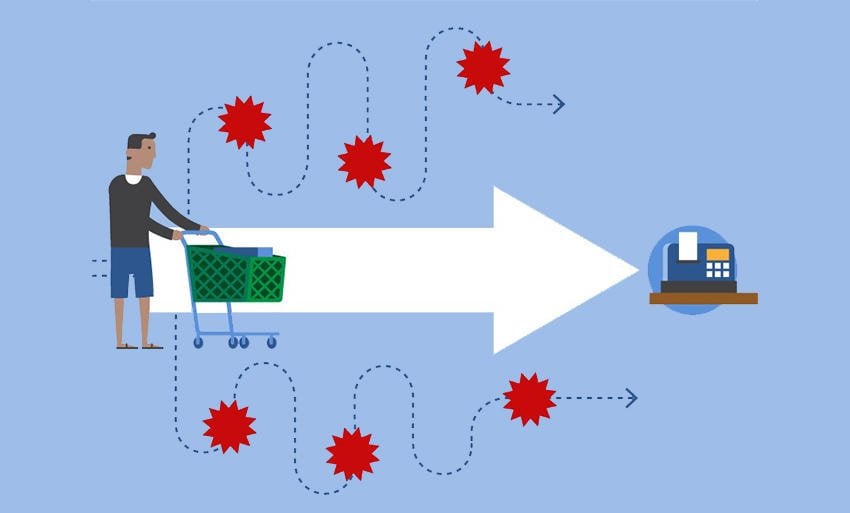

As was mentioned earlier, working in the digital realm online can offer major benefits in collaboration. However, working online also offers the ability to quickly update a current business model canvas or add new business models as they arise. Remember, a business model canvas is a sharable visualization of how your business creates, delivers, and then goes on to capture value. This is the value proposition that leads to enhanced profitability for your business.

Every time a need, such as a new process or product, is added within your business, it prompts the necessity of creating a new business model to address those things. With the speed and ease of working in the digital realm, you have just reduced cost and enhanced your business’s profitability. While these are just three of the most important reasons to use a digital business model canvas template, you can see just how valuable working in the digital arena can be to your bottom line.